Professional Tax in Assam 2025

By Apurba Chakraborty | Update on: 27-August-2025 01:09:47 PM | 6 Minutes Read

Apply for Professional Tax Registration in Assam easily with e-Startup. Get expert assistance, fast processing, and complete compliance for businesses and professionals. Start your registration today!

Table of Contents

Overview of Professional Tax in Assam

Overview of Professional Tax in Assam

Professional Tax in Assam is governed by the Assam Professions, Trades, Callings and Employments Taxation Act, 1947 and its Rules. It applies to salaried individuals, self-employed professionals, and business entities operating in Assam. Employers are required to register and deduct tax from employees’ salaries, while self-employed individuals must obtain enrollment and pay annually.

Types of Professional Tax Certificates:

There are two types of certificates:

1. Professional Tax Enrollment (PTEC):

Professional tax enrollment applies to a wide range of entities, including companies, firms, limited liability partnerships, corporations, societies, Hindu undivided families, associations, clubs, as well as professionals such as legal practitioners, contractors, architects, engineers, tax consultants, management professionals, chartered accountants, lawyers, and medical representatives like doctors and professors.

PTEC Tax Slab Rate In Assam for 2025-2026

Refer to the table below for the updated professional tax rates applicable to above category in Assam.

|

Annual Gross turnover (₹) |

Professional Tax (₹) |

|

₹1 - ₹1,20,000 |

Nil |

|

₹1,20,001 - ₹1,80,000 |

₹ 1,800 p.a. |

|

₹1,80,001 - ₹3,00,000 |

₹ 2,160 p.a. |

|

Above ₹3,00,000 |

₹ 2,500 p.a. |

2. Professional Tax Registration (PTRC):

Applicable for salaried employees, where the employer deducts the professional tax amount from the salary of the employee and deposits the tax to the state government.

PTRC Tax Slab Rate In Assam in 2025-2026

Refer to the table below for the updated professional tax rates applicable to salaried individuals in Assam.

|

Monthly Income (₹) |

Professional Tax (₹) |

|

Up to ₹10,000 |

Nil |

|

₹10,001 - ₹15,000 |

₹ 150 p.m. |

|

₹15,001 - ₹25,000 |

₹ 180 p.m. |

|

Above ₹25,001 |

₹ 208 p.m. |

Procedure for Professional Tax Registration

Procedure for Professional Tax Registration

Application Submission:

- Visit the official website of the Taxation Department, Assam.

- Submit the application form along with required documents.

Verification & Approval:

- The application and documents are verified by the authorities.

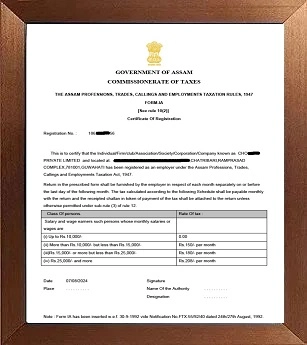

- Once approved, a Certificate of Registration (PTRC or PTEC) is issued.

Payment of Professional Tax:

- Employers need to deduct Professional Tax from employees’ salaries and pay it to the government monthly/annually.

- Self-employed individuals need to pay the tax annually as per the prescribed rates.

Documents Required for Ptax Registration

Documents Required for Ptax Registration

For Employers (PTRC):

- PAN Card and Address Proof of the establishment.

- Trade License / Certificate of Incorporation.

- Details of employees and their salary structure.

- Bank account details.

- Identity & Address Proof of the Employer.

For Self-Employed Individuals (PTEC):

- PAN Card and Address Proof of the individual.

- Proof of Profession (Trade License, Certificate of Practice, etc.).

- Bank account details.

- Identity Proof (Aadhaar, Voter ID, etc.).

Professional Tax Payment Due Date

Professional Tax Payment Due Date

- PTRC: Monthly payment by the 28th of the following month.

- PTEC: Annual payment by 31st May of each year.

Penalties for Non-Compliance

Penalties for Non-Compliance

- Late payment of Professional Tax attracts penalties and interest.

- Non-registration or non-payment may result in legal proceedings and additional fines.

Various Ptax Forms in Assam

Various Ptax Forms in Assam

The Assam Commercial Tax Department requires various forms for Professional Tax-related processes. The main forms include:

|

Application Form |

Category |

|

Application for Certificate of Registration / Amendment of Certificate of Registration |

|

|

Certificate of Registration |

|

|

Application for a Certificate of Enrolment / Amendment of Certificate of Enrolment |

|

|

Certificate of Enrolment |

|

|

Certificate to be furnished by a person to his employer |

|

|

Certificate to be furnished by a person who is simultaneously in employment of more than one employer |

|

|

Return |

|

|

Application for permission to furnish returns covering quarter, six months or a year |

|

|

Statement of Recovery |

|

|

Information to be furnished |

|

|

Notice to a defaulting enrolled person |

|

|

Notice for showing cause against non-enrolment |

|

|

Assessment Order |

|

|

Notice of Demand |

|

|

Challan |

|

|

Challan |

|

|

Assessment Register |

|

|

Refund Voucher |

|

|

Refund Register |

Frequently Asked Questions

Frequently Asked Questions